Title Loans Louisville KY

One of the most important benefits of title loans in Louisville is their low interest rates. While they do have higher interest rates, they are cheaper than traditional loans. However, this means that they are still more expensive than other loan options. Because of this, the number of direct lenders is limited in the city. Although you can still get a title loan in Louisville for less than $2,000, the interest rate on these loans is high. The loan amount must also be paid back within 30 days, which can be a hassle for people with bad credit.

The next benefit of title loans is the convenience of application. Many lenders can give you money on the spot without requiring you to fill out hundreds of forms. You can apply for a loan online or through a local bank branch. Once you have found a lender, you can submit your application and receive your cash in as little as an hour or two. It will only take a few minutes to complete the process, so you’ll be on your way to getting the money you need.

Car Title Loans Louisville KY

One of the main benefits of title loans in Louisville is that they are easy to apply for. The process can take anywhere from 30 minutes to 24 hours. Once you have submitted the necessary documents, you can walk out with your check for the amount you borrowed. Once approved, you’ll typically have the money in your hand within 48 hours. If you have a good credit score, you can even get your loan approved in just a few hours.

Another advantage of title loans in Louisville is that the lenders aren’t checking your credit. Having bad credit can make it difficult to get a financial loan, but these lenders won’t run a credit check on you. The process is fast, simple, and secure, so it’s best to apply for an auto title loan right away. It’s a secure way to get the money you need, without compromising your credit.

Car Equity Loans Louisville KY

Because title loans are collateral-based loans, they are a great alternative to bank loans. They require that you provide your car title as collateral. If you have a car that is worth less than the loan, you can use your title as collateral for an auto title loan. When you get approved, you can have a small, convenient loan in as little as six hours. This will allow you to pay off the loan in a few days.

The easiest type of loan is an auto title loan. You can apply for a title loan in Louisville if you own a car. Obviously, it will cost more than a general bank loan, but it’s worth it because you can use it in an emergency. The key difference between an auto title loan and a normal bank loan is the interest rate. The interest rate of an auto title loan is much lower than a standard personal loan, and you’ll be able to take it out quickly if you’re eligible for it.

Title Pawn Louisville KY

Among the major benefits of Louisville car title loans is affordability. Because the interest rates on a car title loan are often higher than other types of loans, they are also more affordable than other forms of loan. In some cases, a Louisville title loan will even allow you to keep your car, which can be a big advantage if you have a hard time paying back the loan. If you do, you can also choose to extend it or return the loan to the lender.

The other primary benefit of a Louisville title loan is that you can apply for up to 80% of the vehicle’s value. This is a far higher amount than a payday loan, and is a great way to avoid high interest rates. Because the interest rate on auto title loans is relatively high, it should only be used as a temporary solution in an emergency. It is recommended to only use the loan for an emergency, and a second loan for a separate car.

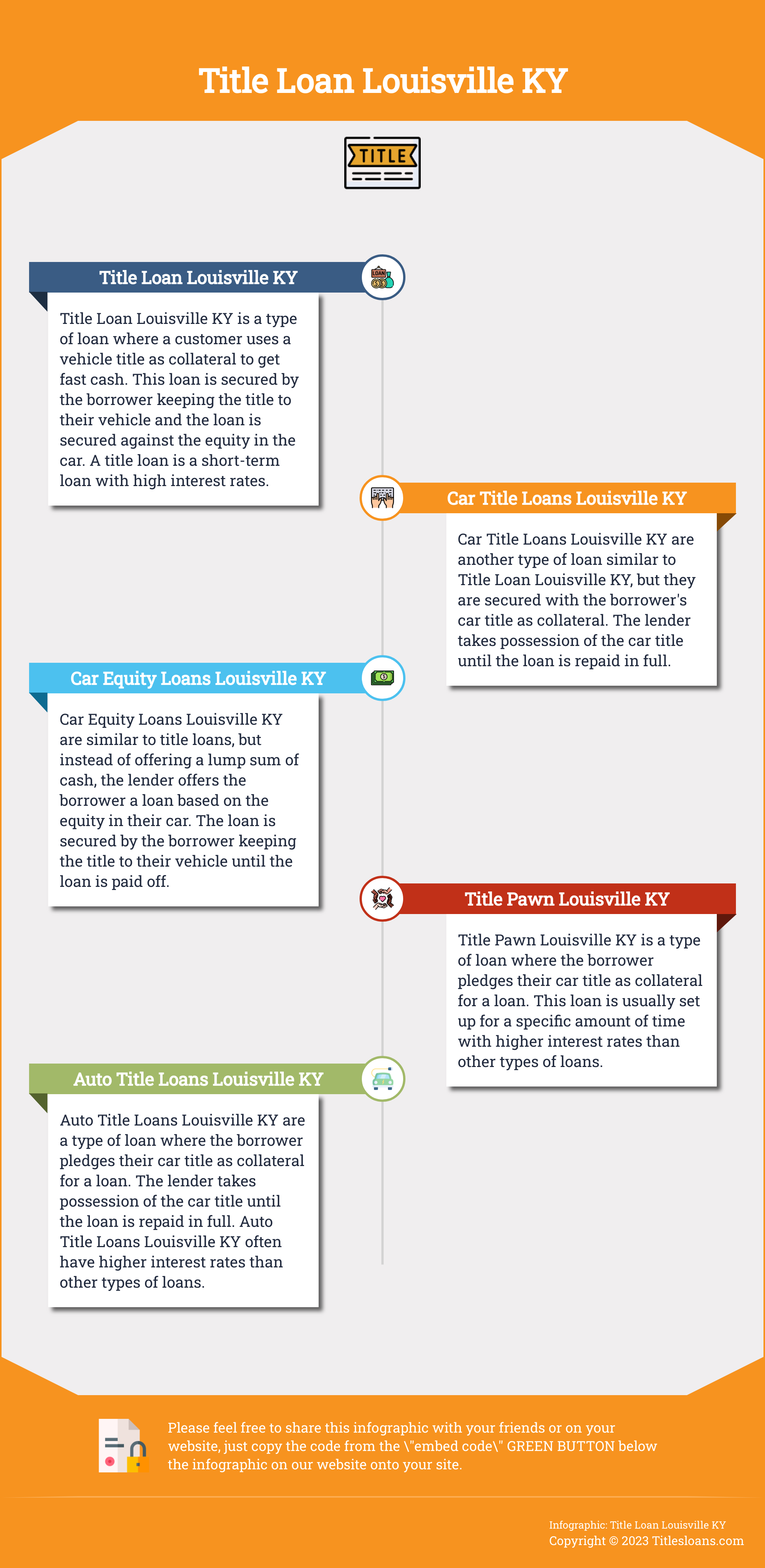

Title Loan Louisville KY

Title Loan Louisville KY is a type of loan where a customer uses a vehicle title as collateral to get fast cash. This loan is secured by the borrower keeping the title to their vehicle and the loan is secured against the equity in the car. A title loan is a short-term loan with high interest rates.

Car Title Loans Louisville KY

Car Title Loans Louisville KY are another type of loan similar to Title Loan Louisville KY, but they are secured with the borrower’s car title as collateral. The lender takes possession of the car title until the loan is repaid in full.

Car Equity Loans Louisville KY

Car Equity Loans Louisville KY are similar to title loans, but instead of offering a lump sum of cash, the lender offers the borrower a loan based on the equity in their car. The loan is secured by the borrower keeping the title to their vehicle until the loan is paid off.

Title Pawn Louisville KY

Title Pawn Louisville KY is a type of loan where the borrower pledges their car title as collateral for a loan. This loan is usually set up for a specific amount of time with higher interest rates than other types of loans.

Auto Title Loans Louisville KY

Auto Title Loans Louisville KY are a type of loan where the borrower pledges their car title as collateral for a loan. The lender takes possession of the car title until the loan is repaid in full. Auto Title Loans Louisville KY often have higher interest rates than other types of loans.