Title Loans Pittsburgh PA

In the current economic climate, people all over the country are struggling with their finances. With title loans in Pittsburgh, you don’t need to worry about personal bankruptcy or ruining your credit rating. You can get the money you need to make ends meet until your next paycheck. Because the money is secured against the title of your car, the interest rate is fixed, so you won’t have to worry about paying high interest rates.

Unlike other traditional types of loans, title loans in Pittsburgh, Pennsylvania are quick, convenient and hassle-free. If you own a car and can prove that it is yours, you could get your money within 24 hours. With these types of loans, you don’t even have to worry about your credit score – the approval is instant. In addition, title loans in Pittsburgh, Pennsylvania don’t require a credit check, making them perfect for those without an excellent credit score.

Car Title Loans Pittsburgh PA

Another benefit of title loans in Pittsburgh, PA is that they can help you out when you need it most. Because of the quick approval, you can get your money within one business day. They’re also perfect for people who own their cars outright and are gainfully employed. Lastly, most title loans are paid back in a month or less. As a result, there’s no need to make a long-term financial plan, and there’s no monthly installment to worry about. And they are a great option if you have an emergency.

While you’ll need to make monthly payments to repay your title loan, these are comparatively easier to pay off. In most cases, you can pay off the initial amount without incurring any interest. However, once you reach the second month, you’ll have to pay the interest, and this can be expensive. Therefore, you’ll want to pay off the loan in full as soon as possible to minimize the amount of interest you’ll be charged.

Car Equity Loans Pittsburgh PA

Because the lender’s security is tied to your car, you’re not risking your car. It’s also a great way to get a small loan for emergency situations. A good title loan can save you time and money when you need it most. A quick approval is very important for your title loan, so don’t wait. The money is waiting for you when you need it most. A great way to get out of a bind is by using your car as collateral.

While title loans in Pittsburgh are generally the cheapest form of loan, they are not the best option for everyone. The APR is often too high, and if you don’t pay it back in a timely manner, you may end up losing your car. So, before you sign on the dotted line, make sure you have a plan for paying back your loan. Then, you can pay off your loan as soon as possible.

Title Pawn Pittsburgh PA

When you need fast cash, a title loan can provide it. These short-term loans require a vehicle title, which is often a valuable asset. Unlike traditional bank loans, title loans are secured against the vehicle’s value and you have the right to claim ownership of your car until you pay it back. With a title loan, you’ll enjoy no credit checks and no hassles, and you’ll have money to make ends meet in the shortest amount of time.

Because title loans in Pittsburgh Pennsylvania are secured against the title of your car, they are among the safest and easiest ways to get cash. While most banks require borrowers to present a car title, you can use your title as collateral to secure a title loan in Pittsburgh. The interest rate is capped at 30%, and you can pay it back within 30 days. If you’re in need of cash immediately, a Pittsburgh title loan can provide it.

In Pittsburgh, you can choose from a wide range of financing options, including secured and unsecured loans. Unlike traditional bank advances, title loans require no credit checks, which makes them a popular option for those who have bad credit. And because these loans are secured by collateral, they are usually much cheaper than a typical bank loan. You’ll only need to pay about a quarter of the amount you borrow each month, depending on how much you need to spend.

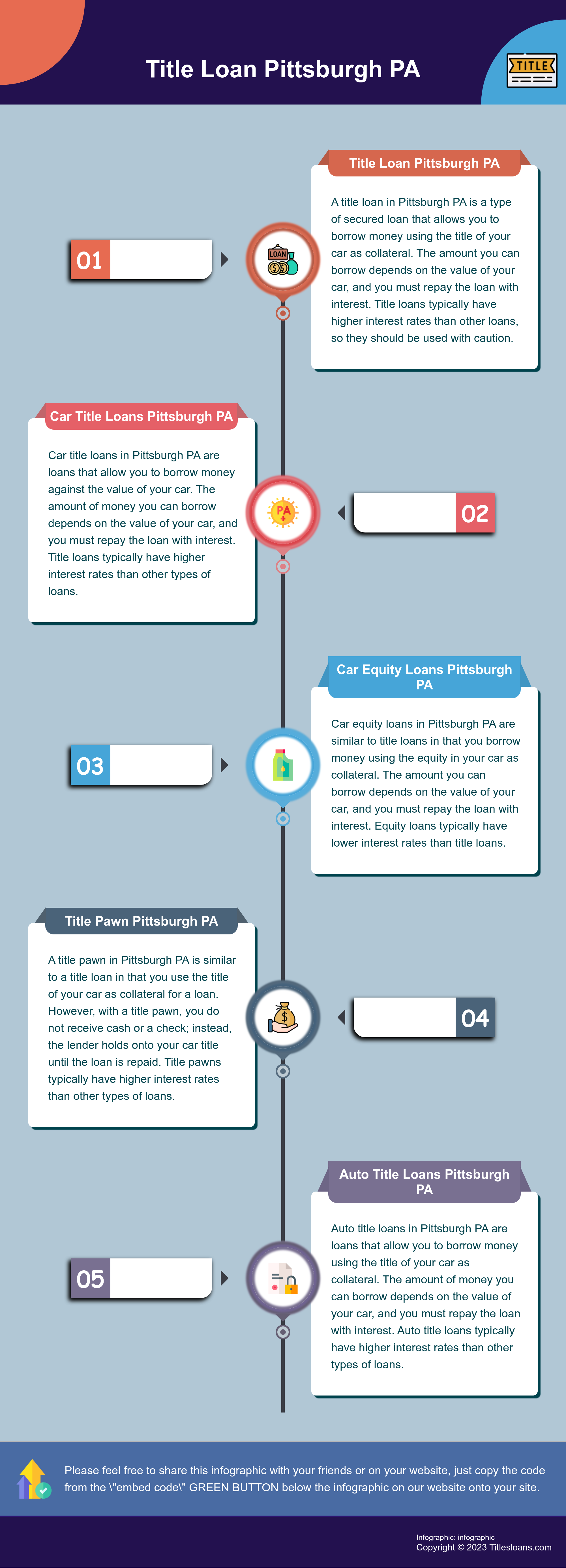

Title Loan Pittsburgh PA

A title loan in Pittsburgh PA is a type of secured loan that allows you to borrow money using the title of your car as collateral. The amount you can borrow depends on the value of your car, and you must repay the loan with interest. Title loans typically have higher interest rates than other loans, so they should be used with caution.

Car Title Loans Pittsburgh PA

Car title loans in Pittsburgh PA are loans that allow you to borrow money against the value of your car. The amount of money you can borrow depends on the value of your car, and you must repay the loan with interest. Title loans typically have higher interest rates than other types of loans.

Car Equity Loans Pittsburgh PA

Car equity loans in Pittsburgh PA are similar to title loans in that you borrow money using the equity in your car as collateral. The amount you can borrow depends on the value of your car, and you must repay the loan with interest. Equity loans typically have lower interest rates than title loans.

Title Pawn Pittsburgh PA

A title pawn in Pittsburgh PA is similar to a title loan in that you use the title of your car as collateral for a loan. However, with a title pawn, you do not receive cash or a check; instead, the lender holds onto your car title until the loan is repaid. Title pawns typically have higher interest rates than other types of loans.

Auto Title Loans Pittsburgh PA

Auto title loans in Pittsburgh PA are loans that allow you to borrow money using the title of your car as collateral. The amount of money you can borrow depends on the value of your car, and you must repay the loan with interest. Auto title loans typically have higher interest rates than other types of loans.